Understanding the intricacies of financial statements is crucial for businesses of all sizes. An income statement, also known as a profit and loss statement, is a fundamental tool that provides a clear view of a company’s financial performance over a specific period. The “20 5000 income statement template” is designed to simplify this process, offering a structured format that can be easily adapted to suit the needs of various businesses.

Whether you’re a startup or an established enterprise, the template serves as a guide to ensure all relevant financial information is accounted for. From revenue streams to operating expenses, the template helps in categorizing each element to provide a comprehensive overview. It’s not just about recording numbers; it’s about understanding the story they tell about your business’s health and trajectory.

The “20 5000 income statement template” is more than just a document; it’s a roadmap to financial clarity. By breaking down earnings and expenditures, companies can make informed decisions that drive growth and profitability. Let’s delve into the details of how this template can be utilized to its fullest potential.

The Importance of a Standardized Income Statement

Standardization in financial reporting cannot be overstated. It allows for consistency, comparability, and reliability across different periods and entities. A standardized income statement like the “20 5000” provides a uniform approach to financial analysis, which is essential for stakeholders, including investors, creditors, and management, to make well-informed decisions.

For small businesses, in particular, adopting a standardized template can be a game-changer. It levels the playing field, allowing them to present their financials with the same professionalism as larger corporations. This standardization also simplifies the transition from small-scale operations to larger, more complex financial environments as the business grows.

Moreover, a standardized income statement aids in regulatory compliance and simplifies the audit process. When financial statements follow a recognized format, it reduces the time and resources needed for auditors to verify the information, leading to more efficient and cost-effective audits.

Lastly, for businesses operating internationally, a standardized template like the “20 5000” ensures that financial statements are prepared in accordance with global accounting standards. This is particularly important for attracting foreign investment or entering into international partnerships.

Breaking Down the “20 5000” Template

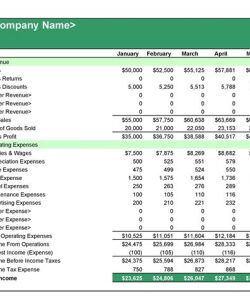

The “20 5000 income statement template” is meticulously crafted to encompass all the necessary components of an income statement. It starts with the top line, which is the total revenue or sales. This figure is the starting point for assessing a company’s financial performance.

Following revenue, the template delineates the cost of goods sold (COGS), which is subtracted from the revenue to calculate the gross profit. This section is crucial as it reflects the direct costs associated with the production of goods or services sold by the company.

Operating expenses are then listed, including selling, general, and administrative expenses (SG&A). These are the costs related to the day-to-day operations of the business that are not directly tied to production. The “20 5000” template ensures that these expenses are clearly separated from COGS to provide a clearer picture of operational efficiency.

The template also includes sections for other income and expenses, such as interest income, interest expense, and taxes. These figures lead to the net income, which is the bottom line of the statement and a key indicator of the company’s profitability.

Utilizing the Template for Business Growth

Implementing the “20 5000 income statement template” is not just about compliance or presentation; it’s a strategic tool for business growth. By regularly reviewing and analyzing the income statement, businesses can identify trends, pinpoint areas of strength, and address weaknesses.

For instance, a consistent increase in gross profit margin could indicate successful cost management or a favorable market response to the company’s products. Conversely, a decline in net income might signal the need for strategic adjustments, such as cost-cutting measures or pricing strategy revisions.

The template also facilitates benchmarking against industry standards or competitors. By comparing financial ratios derived from the income statement, businesses can gauge their performance relative to others in the same sector. This comparison can inspire innovation and motivate improvements in efficiency and profitability.

Furthermore, the “20 5000” template can be instrumental in forecasting and budgeting. Historical data from the income statement can inform future projections, helping businesses to set realistic financial goals and allocate resources effectively.

In conclusion, the “20 5000 income statement template” is an invaluable asset for any business seeking financial success. It provides a clear framework for presenting financial data, which is essential for analysis, decision-making, and communication with stakeholders. By leveraging this template, businesses can gain deeper insights into their financial health and chart a course towards sustained growth and profitability.

Remember, the power of an income statement lies not only in its ability to record past financial activities but also in its potential to shape future business strategies. Embrace the “20 5000 income statement template” as a cornerstone of your financial management practices, and watch your business thrive.